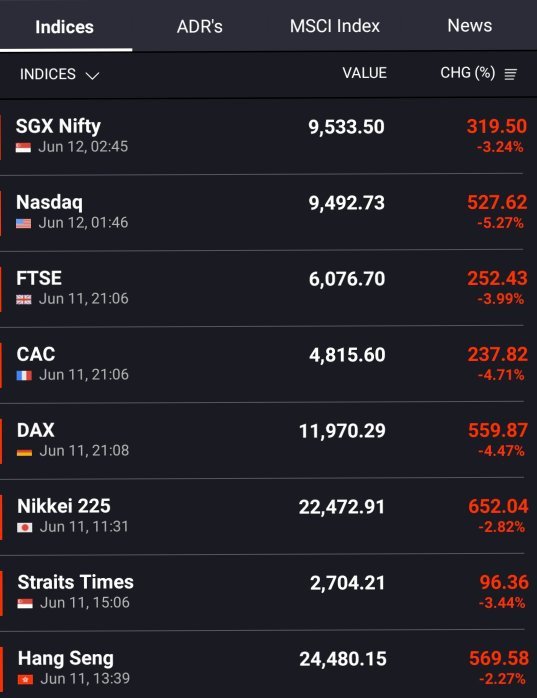

The stock market crash today and Investors lost approximately Rs 30 lakh crore on Tuesday as maximum stocks traded in red barring FMCG stocks like Hindustan Unilever, Nestle India, and Britannia.

It was very bad for the stock market when NDA failed to achieve the magical ‘400 par’ as it had not expected a clear majority for this alliance led by PM Narendra Modi due to the exit polls.

On a day that Sensex and Nifty performed their worst since the pandemic crash, the tables turned for many stocks with Adani facing the worst brunt.

A buffet of stocks that were being labeled ‘Modi stocks’ before the election results was expected to gain with market experts expecting a market rally.

Also Read: Maharashtra Election Results 2024 Live Update

When counting began, all hell broke loose. It was at this time that Sensex went down by over 6,000 points and Nifty also lost close to 2,000 points thereby spoiling Prime Minister Narendra Modi’s earlier claims about his government having achieved a record high in the stock market alongside Home Minister Jay Shah.

Nevertheless, on Tuesday (18th May), almost all of them ended up in red except for some FMCG ones like HUL, Nestle India Ltd & Britannia Industries amid heavy losses worth around Rs 30 lakh crores faced by shareholders.

Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd said, “Dalal Street has gone through a Bloodbath as Nifty collapsed by 5.93%, Sensex and Bank Nifty also saw significant losses.

This happened when investors were disappointed because BJP could not get a majority on its own during the Lok Sabha election in 2024 even though NDA (National Democratic Alliance) had an overall majority.”

Also Read: Paytm News: Paytm Dismisses Adani Stake Sale Reports

What can you expect from the stock market tomorrow?

Aditya Khemka, Fund Manager at InCred Asset Management stated that today’s action marked the beginning of the stock picker’s market and possibly an extended pause for the passive investor.

“We expect the market to remain sideways over the short term and well-positioned businesses with strong earnings momentum and reasonable valuations to out-run the market,” Khemka said.

Also Read: Apple iOS 18 launching on June 10 on WWDC 2024, AI Smart SIRI, and more to expect.

“After this steep fall, we envisage further choppiness, therefore, participants should limit their trades and wait for stability but investors can make use of this opportunity to buy quality stocks available at good bargains”, Ajit Mishra – SVP, Research at Religare Broking Ltd.

Investors must stick to fundamentals and only select stocks having reasonable valuations according to Amit Goel, Co-Founder & Chief Global Strategist of Pace 360.

For the latest news and trending news, follow Newspulse24live on Instagram. and join our WhatsApp group